In every growth-stage boardroom I’ve ever sat in, the GTM tech stack has become the shiny distraction of the quarter. It promises scale, automation, and predictability. But more often, it delivers a mosaic of tools with no orchestration. Everyone has a dashboard. No one trusts the data. The organization, eager to move fast, builds a high-cost house of cards.

By 2025, this cannot continue.

The scale-ready GTM system must evolve beyond cobbled solutions and into designed intelligence—one that honors architecture, not appetite. It must integrate capital discipline with go-to-market clarity. It must allow Finance to lead in signal fidelity and cost rationality while empowering Revenue teams to accelerate execution without entropy. The best stack is not the most automated. It is the most aligned.

I’ve spent over three decades operating at the crossroads of finance, systems, and go-to-market strategy. What follows is a blueprint for what I’ve learned: a stack built not around trends but around throughput; not to impress, but to endure.

Reframing the Stack as a System, Not a Set of Tools

We begin not with features, but with purpose.

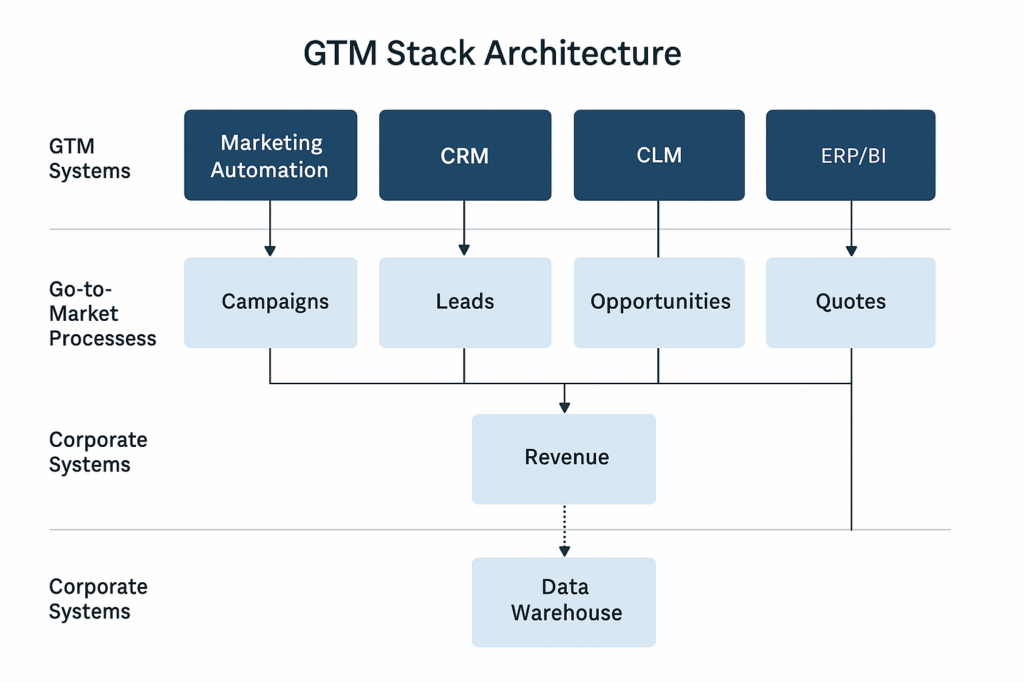

The modern GTM stack must solve for flow: from first signal to cash collection, and ideally renewal or expansion. That flow must reduce friction at every turn. When designed well, it provides feedback faster than the customer can complain. When misaligned, it becomes a glorified spreadsheet factory.

In many organizations, the stack grows laterally. Sales wants a cadence tool. Marketing buys intent software. Legal adds redline automation. Each solves a symptom, but no one models the system. Without orchestration, tech stacks become reactive—each addition creates new data silos, inconsistent definitions, and API dependencies that break under scale.

From the finance chair, I view this proliferation not just as expense growth, but as strategic debt. The true cost isn’t subscription spend. It’s the compounding entropy—reporting rework, revenue attribution drift, and delayed customer feedback. That’s why before approving a new platform, I ask a few questions: What part of the GTM cycle does it accelerate? Where will its signal surface? And how will we know when to retire it?

The CFO as Capital Allocator to Throughput, Not Tools

Every dollar spent on tech is a trade-off against capital efficiency. But that doesn’t mean we restrict innovation. It means we fund systems, not toys.

When my team proposes new stack investments, I don’t ask what it does. I ask what it displaces. Does it improve forecast confidence by 15%? Will it reduce deal desk rework by half? Can it decrease customer onboarding time enough to improve first-year retention?

I treat stack investments as cash flow bets. We model time-to-benefit, data latency impact, and user friction. A tool that removes four hours per week per rep is not worth much if it takes six months to deploy, twelve weeks to enable, and three integrations to stabilize. Our hurdle rate for tooling is internal leverage, not vendor marketing.

When finance operates this way, technology strategy becomes a capital strategy. And the RevOps roadmap transforms into a balance sheet asset, not just an OpEx line.

Stack Hygiene: Governance Before Growth

Most GTM dysfunction hides behind three phrases: “the system didn’t update,” “that’s a Salesforce thing,” and “we pull that from another source.”

This is how companies fall into tech stack entropy. Tools get layered without schema design. Definitions get reinterpreted by region. Each team builds dashboards tailored to its own worldview. Over time, the stack becomes a collection of siloed truths—fast-moving, but structurally incoherent.

To scale, we need stack hygiene. That starts with a shared data model. Every field, stage, and funnel metric must have a common definition, a single source, and a documented owner. This seems basic. It is not. In one post-merger integration, it took us nine weeks to reconcile how three CRMs defined “sales accepted lead.” The metric existed in every system. It just meant something different to everyone.

To prevent this, I embed RevOps inside the CFO function—not to slow innovation, but to ensure semantic control. They oversee data lineage, integration compliance, and reporting governance. They don’t own the stack. They own its integrity.

From Process to Insight: Engineering Signal Overload

A scale-ready GTM stack must do more than track events. It must interpret behavior.

By 2025, signal fidelity becomes the operating moat. The companies that outlearn their competitors will not do so by hiring more analysts. They will do it by designing their stack to surface insight without delay. This is where AI, if applied with systems rigor, plays a powerful role.

We now deploy AI to detect deal decay—moments when engagement slows, stakeholder count drops, or buying intent weakens. But we do not let AI dictate behavior without context. Every predictive model must pass through a systems integrity gate: data sufficiency, bias audit, historical validation, and interpretability.

In my stack reviews, I prioritize tools that explain variance, not just predict outcomes. Precision without explainability is a statistical illusion. I need my teams to act on the why, not just the what.

And when the stack works well, signal becomes strategy. We can reallocate territory, retrain teams, or restructure comp—all within a single planning cycle.

Tooling for Customer Experience: Quote to Cash Without Drag

The most visible test of the GTM stack is the customer journey. From the first call to the signed contract, to the first invoice, customers see not your value proposition—but your process.

Quote-to-Cash must operate as a fluid system. Every handoff—Sales to Deal Desk, Deal Desk to Legal, Legal to Finance, Finance to Collections—must occur within the same choreography. Tools like CPQ, CLM, billing, and ERP must not only connect, but mirror the same logic.

In one global implementation, we discovered that every region used a different quoting tool. Discount logic varied. Approvals bottlenecked. Collections lagged. We unified the quote architecture, introduced guided selling flows, and integrated usage-based pricing logic directly into our forecast model. DSO dropped 17 days. Rep cycle time improved. Renewal rates went up—not because the product changed, but because the customer stopped feeling the operational drag.

This is the hidden value of stack integrity: it shows up in customer sentiment long before it hits the P&L.

The New North Star: Velocity, Not Volume

The next evolution of GTM tooling won’t be about coverage. It’ll be about velocity. Pipeline health will no longer be measured by size, but by signal strength. Attribution will move from first-touch to persistent engagement. Segmentation will shift from static personas to behavioral clusters.

The CFO’s job is to fund for adaptability. Not all tools need to be perfect. But the stack must remain modular. We must be able to sunset point solutions, pilot AI-native platforms, and absorb new data types—without corrupting the system.

That’s why I never allow tooling to outpace taxonomy. Every new input must enrich the decision graph. And every decision must leave a signal trail we can analyze.

This is not about digital transformation. It’s about system intelligence. We aren’t digitizing bad processes. We’re redesigning how GTM learns.

Conclusion: A System Designed to Learn

A well-designed GTM stack does not dazzle. It disappears. It allows go-to-market leaders to make better decisions faster. It aligns Finance, Sales, and Marketing to a shared reality. It turns every click, call, and contract into a compounding advantage.

By 2025, the winners will not be those with the most logos on their stack diagram. They will be those with the clearest signal, the fastest feedback loops, and the fewest blind spots. They will treat the tech stack not as an experiment, but as infrastructure. Not as a cost, but as an engine.

And they will do so not because it was fashionable, but because it was the only rational way to scale.

10 GTM Stack Questions Every CFO Should Ask

- What problem does this tool solve, and for whom?

Every system must map to a friction point in the customer journey or internal GTM execution. If the problem isn’t crisply defined, the tool becomes a cost center with no anchor. - What is the expected time-to-value, and how will we measure it?

A 12-month payback on a 3-month-use tool is a bad trade. Define leading and lagging indicators of ROI before contract signature—not after renewal. - How does this system fit into our existing data model and workflow logic?

Tools that don’t integrate into the core GTM flow often degrade data quality. Ask whether it complements or fragments your operational schema. - Who owns this tool, and who governs its outputs?

Governance is not a function of IT alone. Every GTM system needs both a functional owner (e.g., RevOps) and an accountability mechanism (e.g., dashboard reviews, audits). - How will this tool improve revenue precision or cost leverage?

GTM systems should enhance forecast accuracy, reduce CAC, accelerate pipeline, or shorten cash cycles. If it doesn’t move the needle, it doesn’t make the cut. - What is the failure mode if this tool underperforms or breaks?

Resilience matters. Model what happens when the tool fails: How is data recovered? Which workflows get disrupted? How fast can the team adapt? - Can this tool be sunset or modularized in 12–24 months?

Avoid lock-in. Build for adaptability. Stack components should support deactivation or replacement without requiring a full systems rebuild. - How many systems does this tool touch, and what is the sync cadence?

Tools that update multiple systems asynchronously introduce reconciliation risk. Verify update frequency, latency tolerances, and data accuracy protocols. - How will this tool change user behavior?

Systems don’t just support processes—they shape them. Ask whether reps, CSMs, or marketers will change how they qualify, engage, or escalate because of this system. - What dashboards or decisions will this tool enable that we couldn’t make before?

If the system doesn’t improve the fidelity of decisions—pricing, forecasting, territory planning, churn intervention—it is not a strategic asset.

Discover more from Insightful CFO

Subscribe to get the latest posts sent to your email.