Scaling Your Fractional CFO Firm: Key Steps

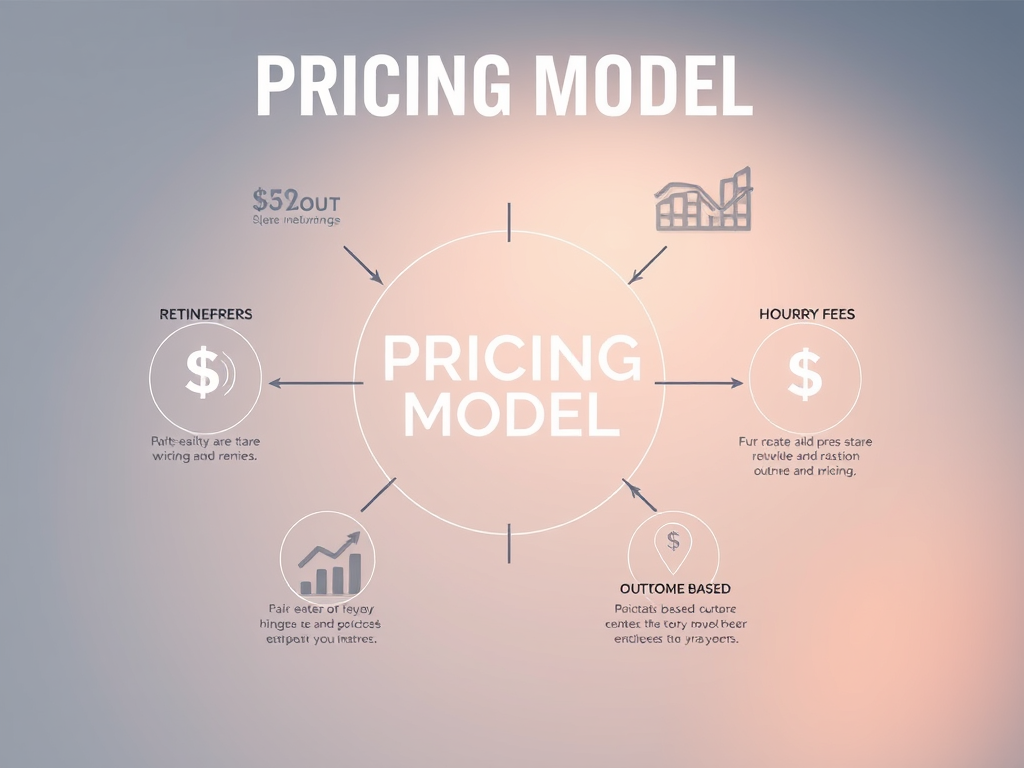

Many fractional CFOs encounter challenges as they become overwhelmed with client demand, leading to the choice of scaling their solo practice into a firm. This process involves identifying triggers for scaling, choosing a firm model, establishing operational infrastructure, pricing strategies, hiring effectively, preserving quality, and planning the business model shift.