The CFO’s Guide to Actionable Lead Attribution

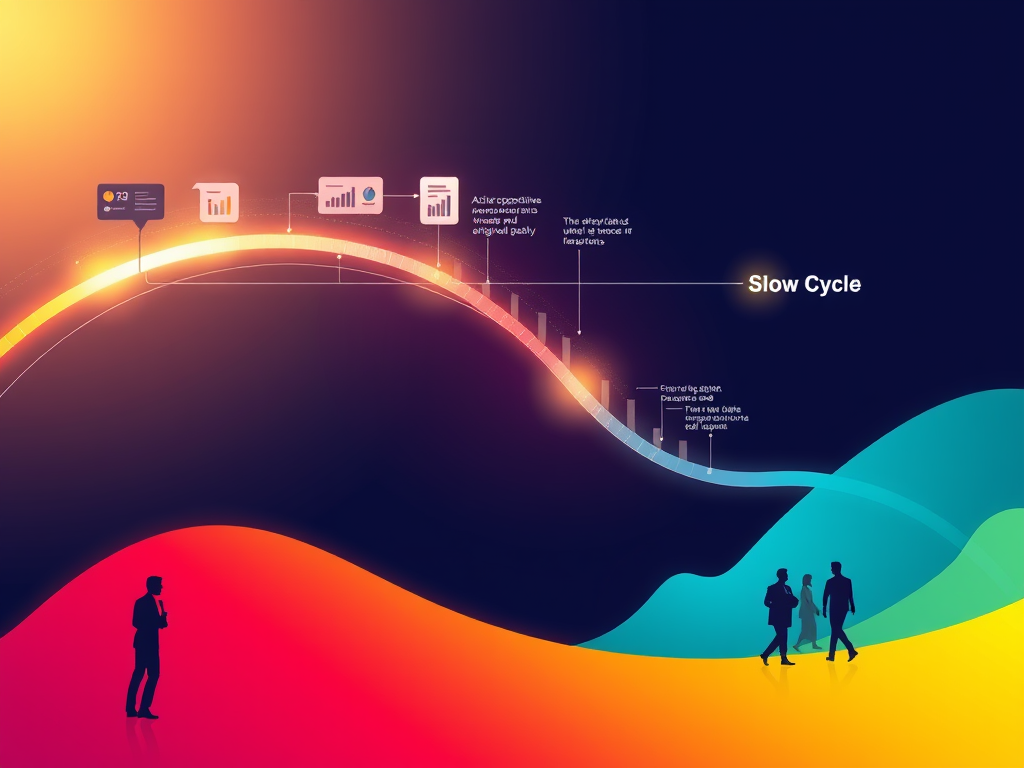

The author reflects on evolving lead attribution from a tactical tool to a strategic framework in finance, emphasizing its importance in understanding customer journeys and aligning various departments. By implementing sophisticated models and localized approaches, they enhanced decision-making, optimized marketing spend, and improved revenue quality, ultimately integrating finance’s insights into operational strategies.