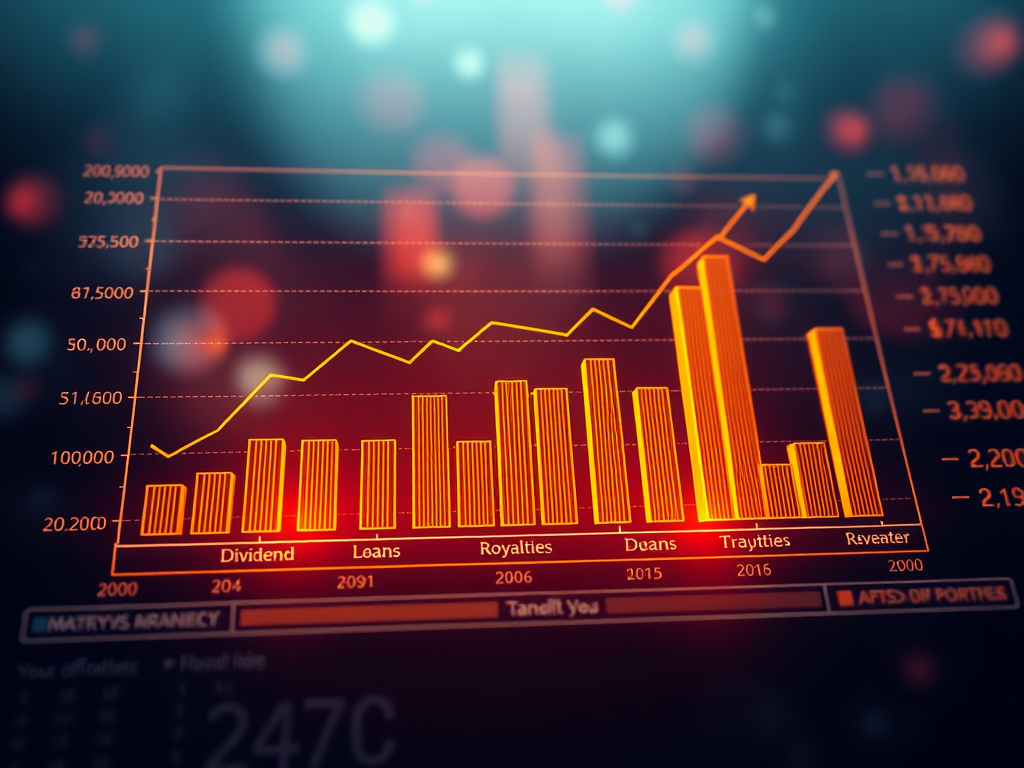

Unlocking Revenue Growth Through Strategic Forecasting

High-performing enterprises prioritize strategic forecasting to drive smarter revenue growth. This disciplined process integrates market signals and analytics to inform decision-making and resource allocation. In an increasingly volatile business landscape, dynamic and scenario-based forecasting is essential to guide pricing and capacity planning while balancing growth and risk, ultimately optimizing revenue.